Expert Advice: Bagley Risk Management Methods

Exactly How Animals Risk Security (LRP) Insurance Can Protect Your Animals Investment

In the world of livestock financial investments, mitigating risks is extremely important to guaranteeing economic stability and development. Animals Danger Protection (LRP) insurance policy stands as a trusted shield versus the unforeseeable nature of the marketplace, using a strategic strategy to securing your assets. By diving into the complexities of LRP insurance policy and its complex advantages, animals manufacturers can strengthen their investments with a layer of safety and security that goes beyond market changes. As we discover the world of LRP insurance coverage, its function in safeguarding livestock investments becomes significantly noticeable, promising a path towards sustainable monetary durability in an unstable sector.

Understanding Livestock Danger Protection (LRP) Insurance Coverage

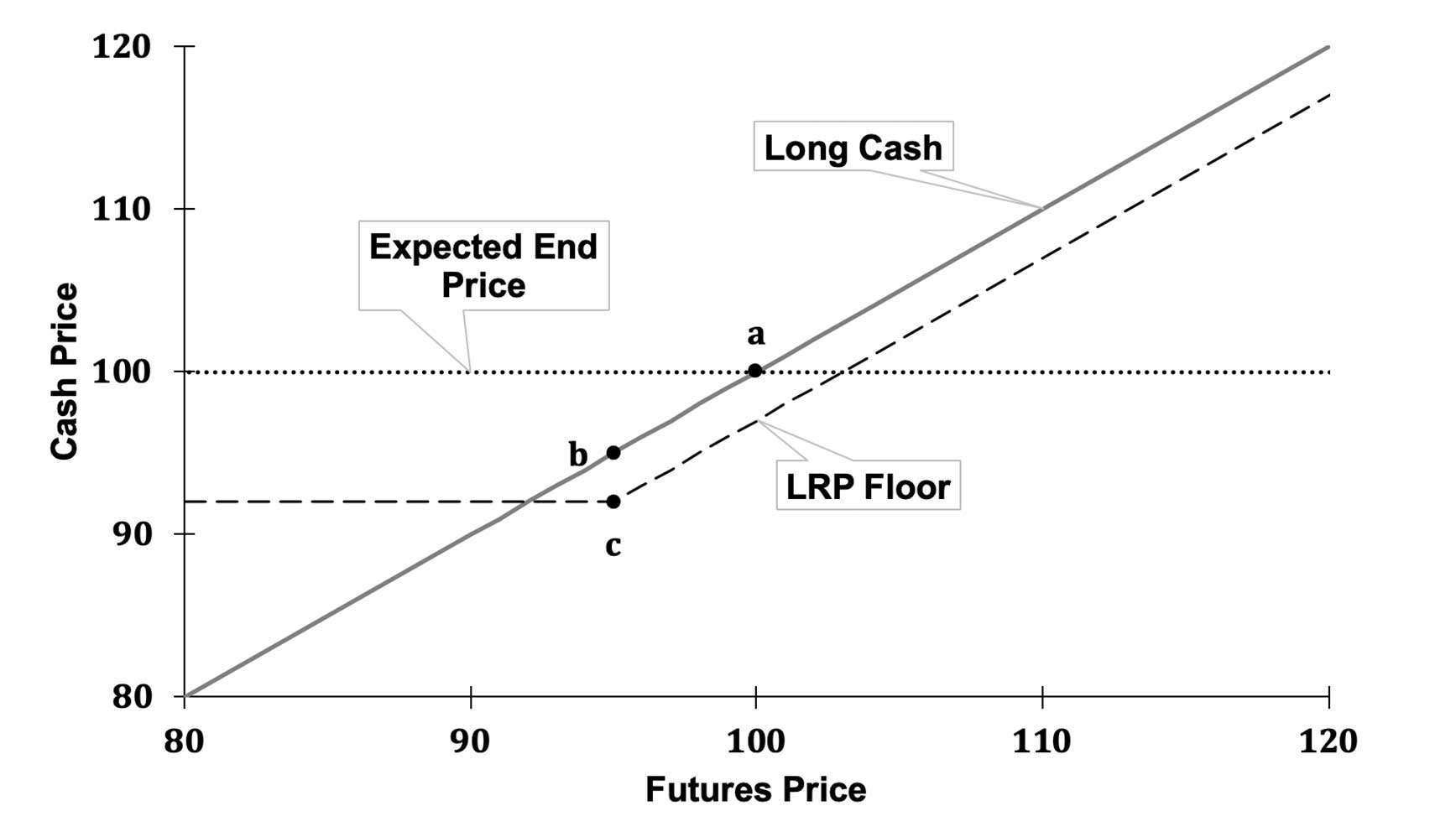

Recognizing Livestock Risk Defense (LRP) Insurance coverage is vital for animals producers looking to minimize monetary threats connected with price variations. LRP is a federally subsidized insurance coverage product made to safeguard manufacturers against a decline in market costs. By offering coverage for market rate declines, LRP aids producers secure in a flooring cost for their animals, making sure a minimum degree of revenue no matter market fluctuations.

One secret aspect of LRP is its adaptability, enabling manufacturers to customize insurance coverage degrees and plan lengths to suit their details demands. Manufacturers can pick the number of head, weight array, protection rate, and insurance coverage period that straighten with their manufacturing goals and run the risk of resistance. Comprehending these customizable choices is essential for manufacturers to effectively handle their price danger exposure.

Additionally, LRP is available for various animals kinds, consisting of cattle, swine, and lamb, making it a flexible threat administration tool for animals manufacturers across various industries. Bagley Risk Management. By acquainting themselves with the ins and outs of LRP, manufacturers can make informed choices to safeguard their investments and make sure economic security in the face of market uncertainties

Benefits of LRP Insurance Coverage for Livestock Producers

Livestock manufacturers leveraging Animals Danger Defense (LRP) Insurance policy obtain a critical benefit in securing their investments from price volatility and protecting a secure economic ground among market uncertainties. One vital benefit of LRP Insurance policy is price security. By setting a flooring on the rate of their livestock, manufacturers can reduce the danger of substantial monetary losses in case of market declines. This enables them to intend their spending plans better and make notified decisions about their procedures without the continuous concern of cost changes.

Moreover, LRP Insurance coverage provides manufacturers with satisfaction. Understanding that their financial investments are protected versus unforeseen market changes permits manufacturers to concentrate on other elements of their company, such as improving animal wellness and welfare or enhancing production procedures. This satisfaction can bring about increased productivity and earnings in the lengthy run, as manufacturers can run with even more self-confidence and security. Overall, the benefits of LRP Insurance for livestock producers are considerable, using a beneficial device for handling threat and making sure economic security in an unpredictable market atmosphere.

Just How LRP Insurance Mitigates Market Risks

Alleviating market threats, Livestock Risk Protection (LRP) Insurance coverage offers livestock manufacturers with a trusted shield versus cost volatility and financial unpredictabilities. By providing defense against unanticipated price declines, LRP Insurance coverage aids producers safeguard their investments and keep monetary security when faced with market fluctuations. This kind of insurance permits animals producers to lock in a price for their pets at the beginning of the plan duration, guaranteeing a minimum price degree regardless of he said market adjustments.

Actions to Secure Your Livestock Financial Investment With LRP

In the realm of agricultural danger management, executing Livestock Threat Defense (LRP) Insurance includes a calculated procedure to safeguard financial investments against market fluctuations and unpredictabilities. To secure your animals investment effectively with LRP, the first action is to evaluate the certain threats your operation deals with, such as rate volatility or unexpected weather condition occasions. Next off, it is important to study and pick a trustworthy insurance company that supplies LRP policies tailored to your animals and organization needs.

Long-Term Financial Safety And Security With LRP Insurance Policy

Guaranteeing withstanding monetary security with the utilization of Livestock Danger Protection (LRP) Insurance policy is a prudent long-term strategy for agricultural manufacturers. By including LRP Insurance policy right into their danger management plans, farmers can guard their animals investments against unforeseen market variations and negative events that could threaten their economic health gradually.

One secret benefit of LRP Insurance for long-term economic safety is the peace of mind it offers. With a reputable insurance plan in place, farmers can minimize the monetary dangers connected with volatile market problems and unanticipated losses due to variables such as condition break outs or natural calamities - Bagley Risk Management. This stability permits producers to concentrate on the daily procedures of their livestock business without consistent fret about potential financial problems

In Addition, LRP Insurance coverage supplies a structured approach to taking care of threat over the lengthy term. By setting details protection levels and selecting proper endorsement periods, farmers can customize visit site their insurance prepares to straighten with their financial goals and take the chance of tolerance, making certain a safe and secure and lasting future for their livestock operations. To conclude, buying LRP Insurance is a positive approach for agricultural producers to accomplish lasting monetary protection and protect their incomes.

Verdict

To conclude, Animals Threat Protection (LRP) Insurance policy is an important device for livestock manufacturers to mitigate market dangers and safeguard their investments. By recognizing the advantages of LRP insurance coverage and taking actions to execute it, manufacturers can attain lasting economic security for their operations. LRP insurance provides Read Full Article a safeguard versus rate variations and makes certain a degree of stability in an unforeseeable market environment. It is a wise choice for safeguarding livestock investments.